The most convenient world-view has always been that technology, machines, AI is going to solve all our problems for us. In the Financial Advisory world, the latest buzz-word has been ‘Robo-Advisors’.![]()

Even before almost everyone has a pocket-sized computer (i.e. smart-phone) we were inundate with the marvels of what technology can do for us, without considering that technology is in fact a piece in a larger system. The degree to which technology can function in that system is based on it’s qualities to ‘fit’, ‘work’ and be complimentary to all other roles in the system. The other actors in the system in the case of the financial advisory practice are people (e.g. you, your employees, your clients) and your business.

Being Human versus Robo-advisers

In a recent NAPFA Webinar I gave, I provided a perspective as a seasoned Human Factors Designer. I have close to a decade as an Industrial Engineer and Human Factors designer where we often challenged the conventional ways that most engineers thought. Back even 10 years ago, the usability, the ease-of-use of a product, wasn’t considered as important in the guide of many engineers. Nowadays, it’s probably one of the most important differentiator of products and services.

On the NAPFA Webinar, I illustrated and compared robo-advisors to the rise of automated/driverless cars. We’ve been hearing in the mainstream news almost on a constant basis these past few years of Google’s foray into this new technology and Telsa isn’t far behind. There are studies out done touting the benefits to the economy. And indeed there are benefits. But even the latest studies shows that not all accidents can be erased with an algorithm as seen in this picture below. There still needs to be people involved, not to mention the challenges that will arise that were entirely unexpected like ‘mode confusion’ that the human driver of the car may not expect.

Make Humans Conform to the Tech, Not the Other Way Around

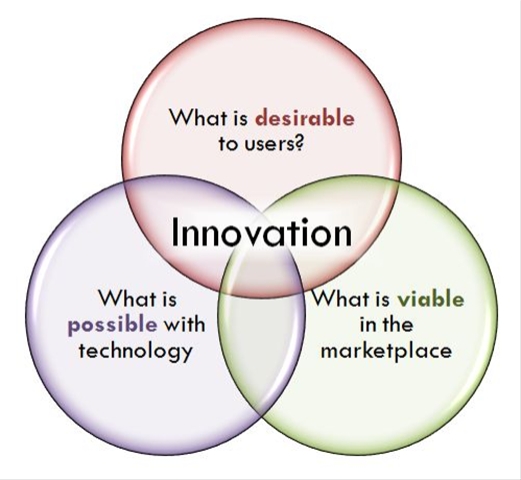

The point is, that even with an very advanced algorithm and even the best technologies, it still requires human interaction. And the bottom line is that all systems are made up of:

- People

- Technology

- Business

Not including any of these into account will be at your peril. Traditionally, people are often the ones being left out to accommodate the technology (robo-advisors). The conventional thinking is that since people are ‘flexible’, the humans in the system should be the ones that pick up any slack that the technology (already developed in most cases) cannot predict.

There are many examples in this in the human factors engineering industry, just look to all the major nuclear accidents, including the one at Three Mile Island, that happened for the past half-century. Almost 90% of them are due to the inability of the design to accommodate the person.

One Last Thing We Often Always Forget is…Pleasure

Back to the example of autonomous cars, this is the current image of people who operate a driverless car. It’s looks kind of silly. We cannot allow for someone to sit in the back-seat, because there will always be potential that requires manual overrides. But yet, the idea of someone sitting, literally, in the driver’s seat without any need for that person to be there (most of the time) just looks silly. In all this talk of driving a car, the one thing that again gets left out is the person. Poor driver is going to be so bored! But wait, you cannot fall asleep cause at any point in time you might need to take over.

Back to the example of autonomous cars, this is the current image of people who operate a driverless car. It’s looks kind of silly. We cannot allow for someone to sit in the back-seat, because there will always be potential that requires manual overrides. But yet, the idea of someone sitting, literally, in the driver’s seat without any need for that person to be there (most of the time) just looks silly. In all this talk of driving a car, the one thing that again gets left out is the person. Poor driver is going to be so bored! But wait, you cannot fall asleep cause at any point in time you might need to take over.

We forgot to factor in the most basic characteristics in the system:

- Boredom

- Pleasure from driving!!!

But instead, the designs of the system are usually drowned out by the merits of a technology-centric view, not a holistic, system-level view. This, once again, is something we design to our peril.

Holistic Planning, Holistic Practice Management

We often neglect looking at systems because our conventional thinking and mindset has always been looking at things in silos.

The alternative to that is to think of your practice management like how you think about planning for your clients — in a holistic, comprehensive way. Practices that are geared toward clients in their comprehensive, holistic planning, the design of your practice should also be considered in that world-view as well in practice management. Holistic practice management that incorporates and understands the abilities and limitations of the people, technology and business will be the most successful no matter how intelligent algorithms (robo-advisors) get.

Learn more about how this human-centred design approach is taken with the design of a simplified client engagement and value proposition system, MyPlanMap. Sign-up below for more information: